- Prologue

- Characters in QE movie

- [Act I] Subprime crisis: toxic assets (2007)

- [Act II] Quantitative Easing (2008)

- Why can’t LOW repo rate solve problem?

- Quantitative Easing: “Electronic” Money OUT OF THIN AIR

- [PHASE] Quantitative Easing Phase 1

- [PHASE] Quantitative Easing Phase 2

- [PHASE] Quantitative Easing Phase 3

- When will Ben stop QE?

- Summary of Quantitative Easing

Prologue

- Next article is Fed tapering and its impact on Indian Economy.

- But to learn fed tapering, first we need to understand Quantitative easing (QE) AND its impact on Indian economy.

- Topic itself doesn’t require more than 15-20 minutes to understand. IF your basics are clear. So make sure you’ve read previous articles:

- RBI monetary policy: quantitative and qualitative tools. Click me

- Debt vs equity click me

- Securitization & Shadow banks click me

Characters in QE movie

Since this is American story, our routine characters (Mohan/Chindu) won’t have big roles in this script. Let me introduce the main protagonists in QE/FT game:

| Ben Bernanke | when Quantitative easing started, He was the boss of “American RBI” (Chairman of US Federal reserves.) Right now Fed Chairman= Jenet Yellen. |

| Leonardo DiCaprio | As such a Hollywood actor. But assume he works in Citigroup’s retail banking operations. i.e. serving American middleclass and small businessmen. |

| Tom Cruise | As such a Hollywood actor. But assume he also works at Citigroup’s Investment operations i.e.

|

[Act I] Subprime crisis: toxic assets (2007)

- Subprime crisis = American banks gave home loan to people who did not have aukaat to repay money. These Borrowers stopped paying installment and the banking system collapses.

- ^this is the crudest, simplest explanation. Most of you know this already.

- But to understand Quantitative Easing and Fed Tapering, we need a little deeper understanding of what exactly happened in subprime crisis? Especailly: mortgage based securities / toxic assets.

| Prime borrower | He has the “aukaat” the repay loan |

| Sub-prime borrower | He doesn’t have the aukaat to repay loan. |

- Initially, American Retail Banker Mr.Leonardo only lends money to “prime” borrowers. And for “repayment-guarantee”, he orders customers to mortgage their property i.e. “if I don’t repay loan, you can take away my house.”

- Thus, Leo has a big pile of mortgage property files say 100 files x 1 lakh dollar worth property each = $100 lakh.

- He gives these files to Tom Cruise, the investment banker.

- Tom prints out 10 lakh bonds, worth $10 each, offering say 4% interest rate. Sells them at American market. We call them “mortgaged backed securities” (MBS).

| Mortgage backed | Because they’re “backedup” by those loan-papers. If anything bad happens, Tom can attach those homes, auction then, and return money to those bond-holders. |

| Securities |

|

- Apart from MBS, they had collateralized debt obligations (CDO), collateralized loan obligations (CLO) and so on. What are they? Not important for exam because too old topic. Just know that, lot of “Securities” were created, that were backed up by those mortgaged home.

- In USA, (sarkaari) treasury bonds offer interest rate of ~2% Obviously, investors will be interested in Tom’s MBS (since it offers 4% return).

| Tom Cruise, the investment banker | Leonardo please get me more loan papers. So, I can printout more MBS securities! And our citigroup makes even more profit! |

| Leonardo, the retail banker | But I’m already done giving loans to every prime borrower. |

| Tom | Then give loans to people who do not have the “aukaat” to repay loans (Subprime borrowers). If they don’t repay, we’ll mortgage property their property. In short, our gameplan is safe and secure. Nothing to worry. |

| Leo | Starts giving loan to sub-prime borrowers. |

- Later, one by one, sub-prime borrowers stop EMI payments.

- But, Tom still has to pay 4% interest to those investors for those mortage backed securities (MBS). So, Tom attaches the houses of loan-defaulters. He tries to auction them, to recover loan money and pay off those stupid investors.

- But since there is such “oversupply” of mortgaged properties, that real-estate market collapses. Imagine fifty Titanics full of onion is dumped at @Mumbai port- what’ll be the price then?

- Same is the situation in American real-estate sector. Original loan amount was $1 lakh but right now, noone is ready to pay even $30,000 for the same home.

- As a result, even HONEST (prime) borrowers feel cheated. “Why should I continue to repay my loan, IF my house is not even worth 30000 dollars?” So, he also stops giving EMI. => more default=> more crash @real-estate.

The Fall of MBS

Thus, within overnight, mortgage backed securities (MBS) have become fancy tissue papers. Because unlike Salman Khan, Tom Cruise cannot keep his “commitment” to pay interest to investors.

What do we have now?

- Mortgaged homes that don’t fetch good prices in auction.

- Mortgage backed securities (MBS), collateralized debt obligations (CDO) and other fancy papers that commend no price in the sharemarket / securities market.

Let’s collectively call them “TOXIC Assets”. (In India, we may have called them NPA, non-performing assets.)

Consequences on World economy

- Due to these toxic assets, lot of investors’ money stuck. Share market collapses. Businesses collapse. Less demand => less jobs => less import of goods and services=> Indian, Chinese every exporter / call center also suffers.

- American FIIs pullout their money from Indian, Chinese, European markets to fill up the losses at home. (Recall, Some Tom Cruise also look after FII operations in India, perhaps with help of Anil “Jhakkas” Kapoor.) => even more slowdown in global economy.

- This also acts as catalyst in PIGS crisis / Greece Sovereign debt crisis (click me)= even more slowdown in world economy.

[Act II] Quantitative Easing (2008)

So far

- American economy collapsed thanks to subprime crisis.

- Banking / financial institutions (like CITIGROUP) have truckload of “TOXIC” assets. (or NPA)

- Investors’ money is stuck.

- Banks are not giving loans to new customers (fearing more toxic assets and loan-default). So, whether its prime borrower or sub-prim borrower- no body getting no more money => no business expansion => no new jobs => no salary=> no demand=> no sales / import.

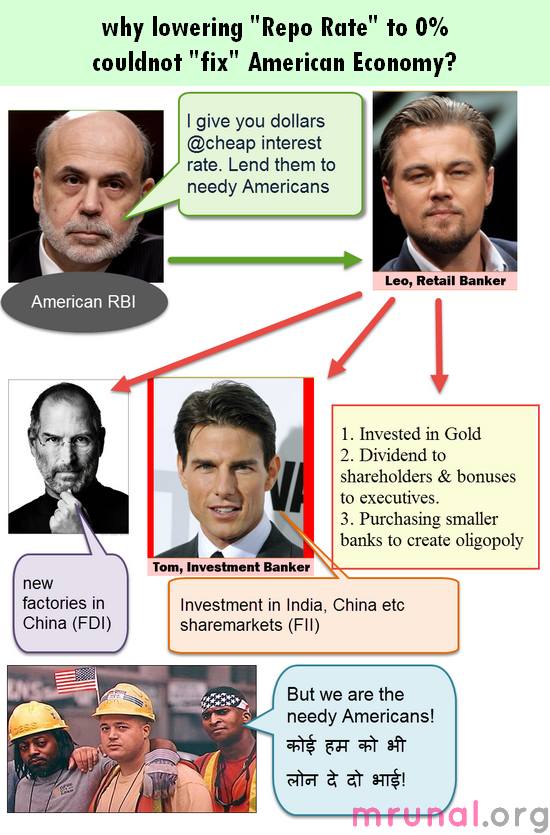

Why can’t LOW repo rate solve problem?

How can American RBI (US Federal reserve) fix this mess caused by Subprime crisis? One solution will be:

- Central Bank should lend (new) money to Retail banks at very cheap interest rate.

- Then Retail banks will also start giving cheap loans to customers=> business expansion => more jobs => more salary => more demand => people buy more=> economy back on track.

- Indian RBI uses “Repo rate” for this. [click me for more]

- American RBI uses “Federal Fund rate” for this. [although mechanism bit different but not really important for exam. So let's not waste time here]

In the 90s, American federal fund rate = used to be in the range of 4-6%. (To crudely put, IF American banks borrowed money from American RBI (US Feds), then American bank will have to pay 4-6% much interest rate.)

Ben Barnanake indeed reduced the interest rate- close to 0% but it didnot workout exactly as planned. Why?

Scene #1: NRI Alok Nath’s Business woos

| Ben Bernanke | (Recall he’s the Boss of American RBI /Chairman of US Fed).Ok fellas, I’m reducing American federal fund rate to 0.25%. Come on! Take loans from me and distribute among your clients. |

| Leo (American retail Banker) | I’m going to borrows truckload of dollars from American RBI because its available at throwaway prices! Have to pay just 0.25% interest rate. |

| NRI Alok Nath | I want to open a marriage-bureau. Please give me loan. |

| Leo | I’m giving no loans to anyone! I’m sick and tired of loan defaults. I want to take no more risk. |

| NRI Alok Nath | Lekin Betaa, you’ve borrowed truckload of cash from American RBI (US Feds). What’re you going to do with all that money? …uskaa achaar daaloge kya? |

| Leo | I’ll do following things with this dollars I got from American RBI

|

| NRI Alok Nath | Ok, then I’m ready to pay 10% interest. Please give me loan. |

| Leo | Sorry uncle-ji. I don’t want to take any risk from any borrower. I already have lot of toxic assets on my plate. Please, try at some other bank. |

| NRI Alok Nath | (leaves the office, but not without giving aashirwaad to Leonardo DiCaprio). |

Scene#2: how to make banks lend money?

Location: Ben Bernanke’s cabin at US federal Reserves (=American RBI)

| Ben | (observing the data of industrial output, employment, GDP everything. )Although I’ve reduced the interest rates, Why is the economy not improving, why is there no business expansion? Why are no new jobs created? Aha….Leonardo DiCaprio is the culprit. He is not passing on my cheap dollars to loan seekers. |

| Ben | (calls up Leo) Man you Stop this nonsense right now, and give loans to those needy American folks. |

| Leo | Not gonna happen. Have lot of toxic assets in my account books. If I give loan to anyone, and he defaults, my Citi group will collapse completely. |

| Ben | But man, those toxic assets are Tom Cruise’s problem. If I recall correctly, you-Mr.Leonardo-Retail banker- you gave loan files to the “investment” arm of Citibank, so Tom must have paid some money to you, right? How come your “department” has “toxic assets”? |

| Leo |

|

| Ben | (agitated, but has to find solution quick, before system collapses further)OK Leonardo. How about I buy the toxic assets Citigroup and all other financial jugglers institutions. Then, will you give loans to those needy customers? Please? |

| Leo | Fair enough. |

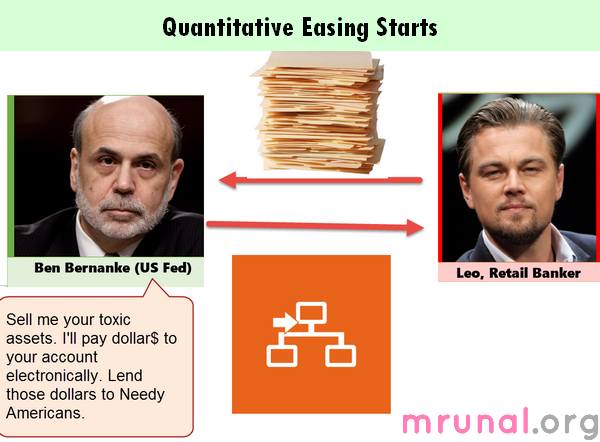

Quantitative Easing: “Electronic” Money OUT OF THIN AIR

- So far, Ben agreed to buy off toxic assets of citigroup and other banks. But Ben doesn’t want to waste time “printing” that much paper currency or coins. He simply types an amount in his super computer at US feds office. And that much (electronic) dollars are automatically created in the banking system.

- When Leonardo (and other retail bankers) sell their “TOXIC ASSETS” to Ben, Mr.Ben will transfer dollar in their account via netbanking.

ok, so, what is happening here? Money supply increased or decreased?

Ans. Increased.

- Because Charlie and other retail bankers sold their tomatoes (toxic assets) to Ben. Ben paid in dollars. So money supply increased (in the sense that now retail Bankers have more money to lend to customers.)

- Does it mean Ben is buying tissue papers in exchange of dollar? (After those MBS/Toxic assets are not much money right?) Well Ben hopes that once economy recovers, those mortgaged houses could fetch higher prices in auction, then he can sell MBS to private investors and recover the money.

This is called quantitative easing

| Quantitative | Quantity of money increased. |

| Easing | “stress / tension” of Banks decreased. because American RBI (US feds) took away their toxic assets |

For MCQ: please keep following concepts in mind

Concept#1: QE = NOT OMO

| OPEN MARKET OPERATION (OMO) | QUANTITATIVE EASING (QE) |

| American RBI sells OR buys government securities (treasury bonds) from the market. | American RBI “buys” securities, including those TOXIC assets. |

| Since they’re only BUYING=> money supply increased. No “If” no “But”. |

| QE Cannot decrease money supply. (Well you have to do a separate thing called “fed tapering”, we’ll see that soon.) For moment, know that QE only INCREASES money supply. QE itself cannot decrease money supply. |

Concept #2: QE = NOT Monetized Debt

| MONETIZING THE DEBT | QUANT.EASING (QE) |

|

|

| American RBI takes “securities” from government and creates more money. | American RBI takes (toxic) “securities” from those bankers, and creates more money. |

| Increases the money supply in the system. | same |

Anyways, let’s move on: Quantitative Easing was done in three phases, starting from 2008.

[PHASE] Quantitative Easing Phase 1

Note: these dates and numbers are not important for exam. I’ve listed them only to demonstrate how events unfolded.

| Nov 2008 |

|

| March 2010 | Phase 1 of QE ends. US feds bought total $1.7 trillion dollars worth securities. |

- Now Ben waits for result. He thinks his plan is “TOTALLY AWESOME”, those toxic assets are out of the banking sector, now those retail banks ought to be giving more loans to Alok Naths => more business expansion =>more jobs=>economy must have bounced back.

- But when Ben analyses the data, hardly anything has improved! Industrial production sucks, unemployment rates are high, GDP growth is low. Why haven’t things changed?

- because retail bankers (Leonardo), is not quickly processing the loan applications of needy Americans.

- Leo is happy that his own toxic assets are cleared. But he still doesn’t want to take risk of giving loans to people. He continues investing money in treasury bonds, gold, (+Tom Cruise investing dollars to foreign countries’ sharemarket as FII).

QE PH1: Impact on FDI / FII

- Quantitative Easing => Dollar supply increased in American market.

- Ben Bernanke hoped these dollars will be given as loans to American people, so they can start new business, create more jobs, produce more goods and services..

- But lot of these dollars did not reach the hands of common Americans.

#1: FDI inflows increased in emerging economies

- Big businesses like Apple, Microsoft, wallmart=> They got cheap loans, but they did not invest it for business expansion in America.

- Because American juntaa did not have the money to buy their products in large amount. So these MNCs started exploring Asian market for new customers.

- They thought “let’s produce phones, camera, laptop and softwares within Asia rather than in USA to save transport costs.”

- So, MNCs used cheap dollar loans for setting new factories / offices in Asian countries.

- Result: FDI inflows increased for Asian countries including India, China.

#2: FII inflows increased in emerging economies

- “MNC” type financial institutions (FI) such as Deutsche Securities, Bank of America, Morgan Stanley, Goldman Sach, JP Morgan Chase, Citizenbank etc.

- They reduced investing in American sharemarket (because nobody buying anything, companies don’t make large profit, hardly any dividends. So why bother in American sharemarket?)

- So, these FIIs took Dollars from America and invested in share/bond/equities/IPO in India-China and other emerging economies.

- Result FII inflows also increased in the emerging economies.

QE PH1: Impact on Exchange Rates

- So far, we know Quantitative easing increased the FDI, FII inflows in emerging market economies.

- what could have happened to exchange rates? Did Rupee strengthen or weaken? Did Dollar strengthen or weaken?

- Ans. Since dollar supply increased (compared to rupee), then Dollar weakens and rupee strengthen. Observe.

| Month | 1$=__ rupees | 1 Rs.=___ $ |

| Jan 2009 | 50 | 0.02 |

| October 2009 | 46 | 0.0217 |

| March 2010 (when QE1 ended) | 44 | 0.0227 |

| Meaning | Dollar weakened | Rupee strengthened |

So what do you see? IS Rupee strengthening or weakening?

Ans. Rupee Strengths, Dollar weakens.

Why? Because if those FDI/FII players want to invest in India, they need to convert their Dollars into rupees.

Imagine dollars are apples.

- Prices of apple vs Rupee are decided by laws of supply and demand.

- If few apples=> each apple will sell for 50 rupees.

- If more apples=> each apple will sell for 44 rupees. (more the quantity, cheaper the product.)

- Same happened with all major currencies in world – yen, yuan, euro, pound, rupee – they “strengthened” while dollar “Weakened”.

Is it good or bad?

Ans. Depends

| If Dollar weakens: | Implications |

| American importer | Bad because he has to give more dollars to buy same amt of Indian products. [] |

| American exporter | Good, because now American products cheaper (for Indian importers) = more demand of American exports. |

| Indian Exporter | Bad |

| Indian importer | Good. |

Enough of Phase 1, let’s move to

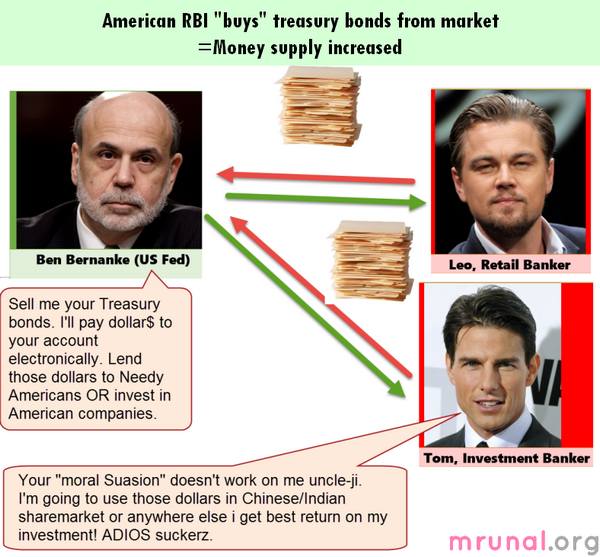

[PHASE] Quantitative Easing Phase 2

Location: Ben’s cabin @American RBI office (i.e. US Federal reserve)

Ben check data on GDP, loan disbursement, industrial production, inflation, unemployment etc. Hardly anything has improved.

| What has Ben Done | What did Leonardo do |

| I bought off Toxic assets (MBS) from Leo | I used most of those dollars to buy treasury bonds, gold, and foreign investment rather than giving’em as loans to needy American people. |

Leo (any American retail bank) is still not processing loan applications quickly. Because there are no “prime” borrowers- left! Almost everyone is broke / subprime thanks to recession. Besides, given the FDI, FII outflows from USA, local companies are not getting any capital to expand business.

| Ben |

|

| November 2010 | Ben starts buying (long term) US Treasury bonds from market. He plans to buy total $600 billion dollars’ worth bonds during QE phase 2. |

| June 2011 | The QE2 phase ends. |

- Is money supply increased or decreased?

- Increased. Because Ben is buying sarkaari bonds from investors, and giving them dollars as payment. Thereby increasing money in the system. [What will happen if Ben started selling treasury bonds? Will money supply increase or decrease? think about it].

- anyways, Ben awaits for result. Analyzes the data. There is some improvement but lot needs to be done. So, later he starts third phase.

Effect of QE2

Again same as last time- FDI, FII inflow increased in emerging economies. Dollar remained weak compared to foreign currencies.

| 2010-11 | $1=__ Rs. |

| Nov 2010 | 44 |

| March 2011 | 45 |

| June 2011 | 45.3 |

You can see rupee almost steady at around 44-45. Meaning dollar kept coming to Indian market in form of FDI and FII. (That’s why rupee demand was higher, and rupee remained strong.)

[PHASE] Quantitative Easing Phase 3

- Ben Bernanke’s situation is like that of a senior UPSC player stuck in a vicious cycle of prelim-mains-interview. His best intentions and efforts are not yielding positive results. Life is in stalemate. Everyone else is winning and making money.

- Ben decides to give third attempt with full preparation- he starts buying both toxic assets (MBS) as well as Treasury bills. [to increase money supply in the market, hope at least some of the dollars will reach to needy American folks.]

| September 2012 |

|

| December 2012 | Ben starts buying $45 billion worth Treasury Bills each month. (+40 bn worth MBS)=45+40= total $85 billion dollars injected in the system every month= dollar supply increased. |

Finally someone (most probably an American civil service aspirant) sends facebook message to Ben:

“Dear Sir-ji,

For how long, will you keep throwing more and more money like a defeated gambler?

For how long, will you keep creating more and more (electronic) dollars out of thin air and let them vanish in India, China and other third world countries?

Man I’m sick and tired of mugging up your QE data for stupid competitive exams. Please stop this nonsense ASAP.”

Sincerely,

A concerned American citizen.

Ben finally gains some enlightenment, “I cannot go on like this forever! Have to stop QE at some point.”

When will Ben stop QE?

| target | Ben’s thought process |

| Inflation 2.5% | If inflation gets higher than 2.5%, I’ll stop QE. Because (moderate) rise in inflation =juntaa is buying more (hence the demand side inflation)= economy has recovered. And since economy has recovered, QE should be stopped. |

| Unemployment 6.5% | If unemployment get lower than 6.5%, I’ll stop QE. Because less unemployment = definitely there is business expansion = American economy Has recovered. No more need for QE. |

- Meaning EITHER inflation >2.5% OR unemployment <6.5%, then I stop QE. Ben had decided these targets in December 2012.

- But Ben cannot suddenly stop Quantitative Easing on one fine morning. He has to slowly reduce it and then stop, otherwise negative consequences in the economy.

- When Ben starts reducing QE, we call it “Fed Tapering”. More details in next article.

Summary of Quantitative Easing

- Quantitative easing [QE] was a novel expansionist monetary policy to contain the negative impact of subprime crisis and put American economy back on growth track. [expansionist because money supply increased]

- Under QE, US Federal reserve (Feds), started purchasing both toxic assets (mortgage backed securities /MBS) and gilt edged securities (treasury bonds) to increase dollar liquidity in the market.

- QE was started in 2008, was carried out in three phases.

- US feds have decided that QE will be stopped when EITHER unemployment rate is less than 6.5% OR inflation is higher than 2.5%.

- QE will not be stopped suddenly. QE will be reduced gradually. This gradual reduction in Quantiative Easing / bond buying pogrom is called “Fed Tapering”.

QE: Good or Bad? (American point of view)

| POSITIVE | NEGATIVE |

|

|

|

|

|

|

| Dollar weakened against foreign currencies, benefiting the American exporters. |

|

| – |

|

QE: Good or Bad? (Indian point of view)

Two main reasons why it was (mostly) bad

#1: Nuisance Hot Money

- Recall Tom Cruise, the investment banker / FII.

- He’ll pump money into Indian share market. Say in ABC Infra. Company. Tom keeps buying and buying= Prices of the shares go higher and higher -1000, 1200, 1500..(supply, demand and speculation).

- The desi investors (aam admi), also buy those shares @1500, hoping its price will rise to 2000 rupees next week.

- But within a week, Tom Cruise (FII)’s expert tell him to invest in Xyz Chinese Company’s shares for better returns. For these billion dollar FIIs, even return difference of 2% will translates to millions. Hence they move money from one nation to another at rapid speed.

- So Tom immediately sells ABC infra shares to pullout his (rupee) money, gets them converted to yuan and buys Chinese company shares.

- Then ABC shares suddenly collapse- barely 700-800 rupees. (supply-demand-speculation)

- As a result, desi investors (aam admi)’s money is lost [because they had bought @1500].

This nuisance of FII hotmoney= one of the biggest reason why sharemarket has gone up and down in a volatile manner in recent years.

#2: Headache for Exporters, Importers & RBI

- In above point, we saw how FII rapidly inject and pull out their money from a country => exchange rates become volatile. (After all, its dollar vs rupee supply demand.)

- Although QE = dollar supply increased = rupee should strengthen. But given the above nuisance of FII “Hot money”, rupee would keep fluctuating. (and we’ve to blame Mohan also- because policy paralysis= provokes FIIs to pullout money.)

- when exchange rates keep fluctuating (say today 1$=55 Rs. and tomorrow $1=65 Rs.), this is not conductive for business planning- neither for importer nor for exporter because they cannot decide their calculations about input cost, taxes, profit margin, everything gets messed up. Long term business planning is mission impossible (thanks to Tom cruise this time!).

- Then RBI has to intervene to keep the exchange rates stable. How? Recall Apples, fridges and Urjit Patel click me

Anyways, let’s check positive and negative impact of US Quantitative easing on Indian economy.

| POSITIVE | NEGATIVE |

|

|

| — |

|

| Rupee strengthened against dollar. (e.g $1=Rs.50 to$1=Rs.40). Good for importers. |

|

| 2012: FII injected ~18 billion USD in Indian market. (That too despite policy paralysis, GAAR controversy.) | They would have invested even more if there was no policy paralysis / GAAR controversy. |

| Cheaper dollar helped Indian corporates to borrow from abroad. | India’s external debt increased (especially when later 1$=became close to Rs.65) |

| RBI’s forex reserves increased. Because cheap dollars, RBI could collect more by selling its rupee reserves in exchange of dollars. | Forex reserve increased only for the first two years of QE. Later hardly any improvement, in fact forex reserve declined in 2013 (when RBI tried to stop rupee downfall by selling its own dollars in market) |

With inputs from Mr.Shivaram G.

Mock questions, after we are done with fed tapering in next article.

Visit Mrunal.org/Economy For more on Money, Banking, Finance, Taxation and Economy.

Did you know that you can shorten your long links with LinkShrink and get dollars from every visitor to your shortened links.

ReplyDelete